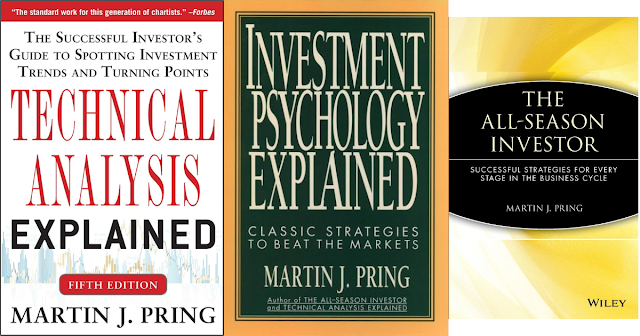

Bộ Sách của Martin J. Pring Giúp Người Học Nắm Vững Mọi Kiến Thức về Phân Tích Kỹ Thuật đầy đủ nhất từ Cơ Bản Đến Nâng Cao, Tâm Lý Thị Trường và Chu Kỳ Thị Trường.

(Đặt in thành quyển sách tại Hoa Xanh theo đường link bên dưới hoặc liên hệ zalo: 0938697600)

Technical Analysis Explained 5th edition 270K

The Successful Investor's Guide to Spotting Investment Trends and Turning Points

Whether you're trading cornerstone commodities or innovative investment products, observing how investors responded to past events through technical analysis is your key to forecasting when to buy and sell in the future. This fully updated fifth edition shows you how to maximize your profits in today's complex markets by tailoring your application of this powerful tool.

- Analyze and explain secular trends with unique technical indicators that measure investor confidence, as well as an introduction to Pring's new Special K indicator

- Expanded coverage on the profit-making opportunities ETFs create in international markets, sectors, and commodities

- Practical advice for avoiding false, contratrendsignals that may arise in short-term time spans

- Additional material on price patterns, candlestick charts, relative strength, momentum, sentiment indicators, and global stock markets

- Properly reading and balancing the variety of indicators used in technical analysis is an art, and no other book better illustrates the repeatable steps you need to take to master it.

Study Guide for Technical Analysis Explained 5th edition 80K

Classic Strategies to Beat the Markets

The All-Season Investor 130K

One essential component of the markets has not--human behavior

In Investment Psychology Explained Martin J. Pring, one of the most respected independent investment advisors in the world. Drawing on the wisdom of creative investors such as Jesse Livermore, Humphrey Neill, and Barnard Baruch, as well as his own experience, Pring shows how to:

- Overcome emotional and psychological impediments that distort decision making

- Map out an independent investment plan-and stick to it

- Know when to buck herd opinion-and "go contrarian"

- Dispense with the myths and delusions that drag down other investors

- Resist the fads and so-called experts whose siren call to success can lead to disaster

- Exploit fast-breaking news events that rock the market

- Deal skillfully with brokers and money managers

- Learn and understand the rules that separate the truly great investors and traders from the rest

Reading Investment Psychology Explained will give you a renewed appreciation of the classic trading principles that, through bull and bear markets, have worked time and again. You'll see, with the help of numerous illustrative examples, what goes into making an effective investor-and how you can work toward achieving that successful profile.

Successful Strategies for Every Stage In the Business Cycle

Martin Pring on Price Patterns 140K

The Investor's Guide to Active Asset Allocation 120K

Martin Pring on Market Momentum

The author offers practical straightforward guidance to modern methods of asset allocation. Explains why each stage in the business cycle--including recession--has its profitable investment strategy and provides various techniques for tracking the cycle in order to choose appropriate investments. A "must-have" for investors seeking guidance for the unknown changes ahead.

The Definitive Guide to Price Pattern Analysis and Interpretation

Martin Pring on Price Patterns covers all key aspects of technical analysis as they apply to price patterns, in text and examples that are clear, convincing, and easy to understand.

Pring provide a complete, in-depth examination of today’s most widely used price patterns, explaining which work better than others and why.

- Insights into widely used one- and two-bar patterns

- Examination of outside bars, reversals, pennants, and more

Using Technical Analysis and ETFs to Trade the Markets

The Investor's Guide to Active Asset Allocation provides you with proven investing expertise on:

- Basic Principles of Money Management

- How the Business Cycle Drives the Prices of Bonds, Stocks, and Commodities

- The Pring Six Business Cycle Stages

- Technical Tools that Help to Identify Trend Reversals

- Putting Things into a Long-Term Perspective

- Recognizing Stages Using Easy-to-Follow Indicators as well as Models

- How the Ten Market Sectors Fit into the Rotation Process

- How Individual Sectors and Groups Performed in Each of the Six Stages

- Asset Allocation for Specific Stages

The book examines the principles underlying market momentum and discusses the advantages and disadvantages of various oscillators used to measure momentum. Written by one of the world's foremost technical analysts, the book breaks new ground in its in-depth discussion of stochastics, relative strength and the very popular MACD indicator. Pring's unique KST system combines oscillators and time cycles to produce very reliable trading signals. Topics include: Interpretation of momentum indicators; Characteristics of overbought and oversold markets; Trends analysis using momentum indicators; pros and cons of all major oscillators; How to use Wilder's directional movement system.